Recent research by Jan Rouwendal, Or Levkovich, Edwin Buitelaar and Jip Claassens, published in Regional Science and Urban Economics, shows that the prices of older commercial buildings increase relative to younger ones. According to the researchers, this is the result of the so-called “vintage effect”: in a growing real estate market, older buildings turn out to become more attractive to new users, which drives up their value.

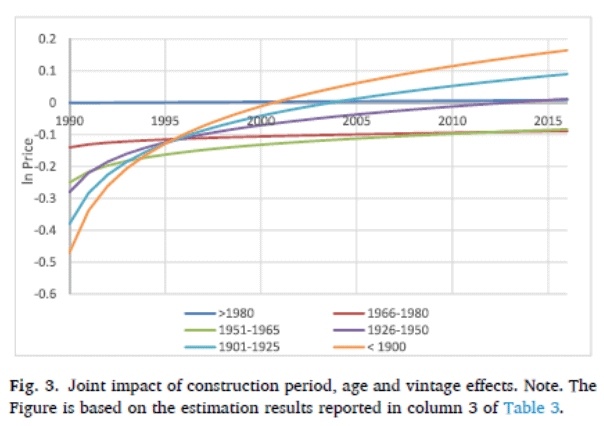

This increase in value cannot be explained by general price trends in the neighbourhood, nor by the buildings’ location in heritage zones. The effect is also not limited to urban areas, and it does not depend on whether a building is a skyline defining element. The vintage effect is particularly strong for buildings constructed before 1960. The figure below, which depicts price developments of buildings from different construction periods, indicates that more recently constructed commercial real estate was generally more expensive in 1990, but that the oldest cohorts subsequently surpassed the younger ones.

Analysis of sales data and research into the office market show that older buildings are not only preserved more often, but are also used more frequently than younger ones. This suggests that commercial buildings have a longer lifespan than is often assumed. The conclusion is also that the built environment changes more slowly than commonly believed, because older buildings remain standing and in use for longer.

Full reference:

Rouwendal, Jan, Or Levkovich, Edwin Buitelaar, and Jip Claassens(2025). Vintage effects in commercial real estate and the dynamics of the built environment. Regional Science and Urban Economics, vol. 114, 104131.